Investing

Are you tired of living paycheck to paycheck? Do you dream of financial freedom and security? You’re not alone. Millions of people struggle to manage their money effectively. But the good news is that with the right knowledge and tools, you can take control of your financial future.

Welcome to the “Complete Personal Finance Course: Earn, Save, and Invest.” This course is your roadmap to financial success. Whether you’re just starting, looking to build wealth, or planning for retirement, this comprehensive guide will equip you with the skills and strategies you need to achieve your financial goals.

Why Guide to Earning Course is Different

With countless personal finance courses available, you might wonder why you should choose ours. Here’s why:

- Real-world Focus: Our course is grounded in practical, actionable steps that you can implement immediately. We avoid overwhelming you with complex financial jargon and focus on clear, easy-to-understand explanations.

- Comprehensive Coverage: We cover all essential aspects of personal finance, from budgeting and saving to investing and retirement planning. You’ll get a well-rounded understanding of how to manage your money effectively.

- Expert Guidance: Our course is developed by experienced financial experts who have a deep understanding of personal finance principles. You’ll benefit from their knowledge and insights.

- Interactive Learning: We believe in hands-on learning. Our course includes interactive exercises, quizzes, and real-world examples to help you apply what you have learned.

- Lifetime Access: Once you enroll, you’ll have lifetime access to the course materials, so you can revisit the lessons whenever you need.

Course Curriculum

1. Budgeting and Expense Management

- Creating a realistic budget

- Tracking your spending

- Identifying and reducing unnecessary expenses

- Building an emergency fund

2. Debt Management

- Understanding different types of debt

- Creating a debt repayment plan

- Strategies for Debt consolidation and negotiation

- Protecting your credit score

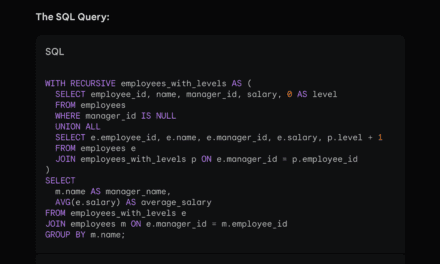

3. Saving and Investing

- The power of compound interest

- Setting savings goals

- Investing basics: stocks, bonds, and mutual funds

- Diversification and asset allocation

4. Retirement Planning

- Understanding retirement accounts (401k, IRA, Roth IRA)

- Calculating your retirement needs

- Developing a retirement savings plan

5. Insurance and Risk Management

- Protecting yourself and your assets

- Types of insurance coverage (health, auto, home, life)

- Risk assessment and management

6. Tax Planning

- Understanding tax basics

- Tax-saving strategies

- The importance of tax planning

Take Control of Your Financial Future

Here are some key steps to help you take control of your finances:

- Set Clear Financial Goals: Have a short-term, medium-term, and long-term financial objective. Whether you dream of owning a home, becoming an entrepreneur, or retiring in style, ensure you make effective financial management. Having clear goals will keep you motivated and focused.

- Create a Sensible Budget: Study your income and expenses to create a budget that aligns with your financial goals. Tracking your spending and identifying areas where you can cut back is important.

- Make an Emergency Fund: Aim to save at least three to six months’ living expenses in an easily available account. This fund will provide a safety net for unexpected financial challenges.

- Manage Your Debt Wisely: Prioritize high-interest debt and develop a repayment plan. Consider debt consolidation or refinancing options if necessary.

- Invest for the Future: Invest early to take advantage of compound interest. Study different investment options like stocks, bonds, and mutual funds.

- Educate Yourself: Continuously expand your financial knowledge through books, articles, and online courses. Stay informed about trends and market conditions.

- Seek Professional Advice: Collaborate with a financial professional to create a personalized financial blueprint.

By the end of the Guide to Earning course, you’ll have the knowledge and confidence to make informed financial decisions. You’ll be able to create a budget, manage debt effectively, save for the future, and invest wisely.

Don’t let financial stress hold you back. Invest in your financial education today and start building the life you deserve.

Do you want to enroll in this course now? Click the Enroll Button now

We wish you the best!